Debt and credit management is an essential aspect of financial planning that individuals cannot afford to overlook. Managing debt effectively helps you to avoid financial stress and can also help you take charge of your finances. It is, therefore, imperative to learn how to manage your debts and credit effectively. Here is a comprehensive guide to help you with that.

- Understand Your Debt and Credit

The first step to managing debt and credit is to understand them correctly. Debt is the amount of money you owe to lenders, credit card companies or other financial institutions, while credit refers to your ability to borrow money. Understanding the difference ensures that you take the right steps towards better financial management.

- Create a Budget

Budgeting is an effective way to manage your finances, including your debts and credit. It helps you allocate funds to essential expenses and ensures that you have enough to meet your obligations. Create a budget that caters to all of your expenses and include a plan to pay off your debts.

- Prioritize Your Debt Payments

Prioritizing your debt payments is crucial in managing your debts effectively. Prioritize high-interest debts like credit card balances and pay them first since they accrue higher interest rates. Once you have cleared high-interest debts, move on to the rest of your debts.

- Avoid Taking on More Debt

Avoid taking on more debt than you can manage. It’s crucial to restrict your credit usage and refrain from taking new loans until you pay off the existing ones. Only use credit when you need it and pay it back on time.

- Negotiate with Creditors

Talk to your creditors if you are struggling to pay off debts. Creditors can provide you with a feasible repayment plan that suits your financial situation. Do not ignore your debts as doing so can potentially damage your credit score.

- Build Your Credit Score

Building a good credit score can make it easier for you to access credit when you need it. Make a habit of paying debts on time, do not max out your credit card limits and avoid opening multiple lines of credit at once.

- Seek Professional Help

If you are having trouble managing your debts, seeking professional help can be an excellent option. Credit counseling can teach you how to manage and pay your debts effectively, while debt consolidation can help you consolidate debts into one manageable payment.

Effectively managing your debts and credit is critical to achieving financial stability. Whether you choose to do it independently or with the help of a professional, take the necessary steps to manage your finances and safeguard your financial future.

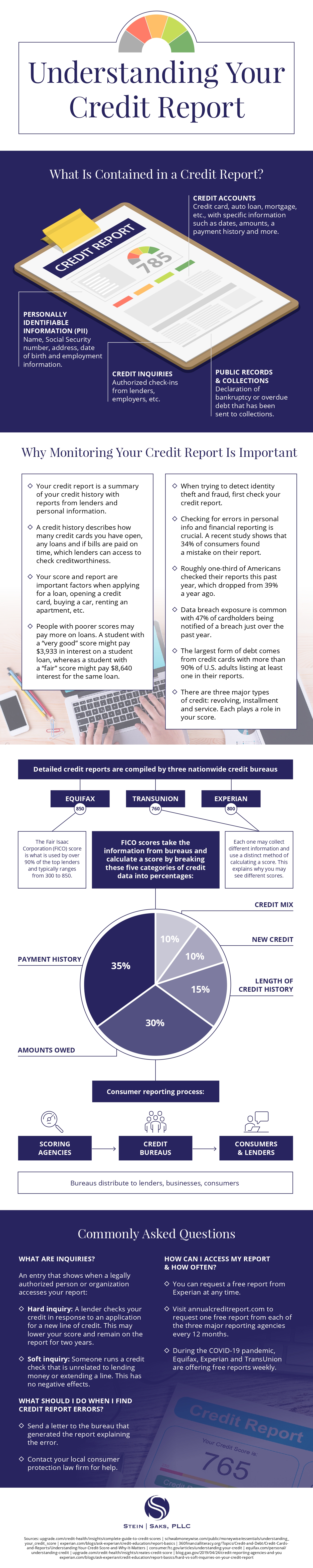

This infographic was created by Stein Saks, learn more about credit reporting laws